Best wishes for the new year! That you may outperform the market in 2023, enjoy the journey and make friends along the way!

This is just a simply “weekly” update. I might do a more elaborate post, looking back at the past 6 months, later.

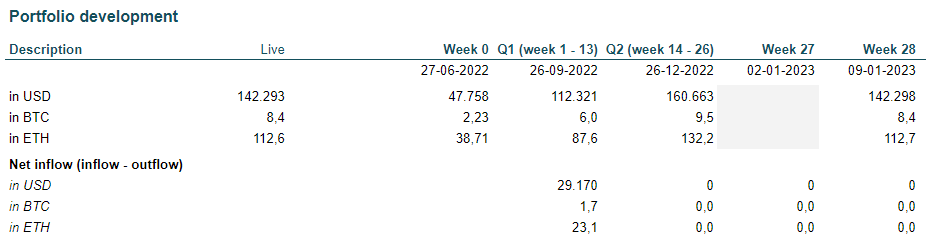

Since I started this blog my portfolio has been performing really well and really steady. Correcting for the inflow of fresh capital I was up by 170% with a maximum drawdown of 5% as of last update.

It is not realistic to expect such a steady way up to continue forever, given the overall risk profile of crypto as well as the individual risks I take.

This update is the first update with a significant (paper) loss of $18k, a 11% drawdown. Mostly related to Kostren Finance (KTN).

Kostren Finance update

I recently wrote a piece about one of my higher conviction bets, Kostren Finance. The liquidity for Kostren is really thin, especially sub $45 dollars (above that there was significant protocol owned liquidity).

Last week there was significant panic in the Kostren community that the team would potentially rug. Some people already called it a rug and panic sold there position.

When I looked at the panic - it looked like it was mostly caused by a combination of a lack of communication from the team, a crashing price as well as absolute lack of liquidity below $45. The above ingredients combined with a community full of PTSD (who hasn’t in crypto?) is a recipe for disaster.

I was quite comfortable about all of the above until the team interacted with Sideshift. A privacy focused exchange which has been used by many hackers and fraudsters in the past. This definitely makes me uncomfortable, there is zero need for the team to randomly interact with this platform.

At the same time, the team to date has more or less sticked to the roadmap and promises and could have rugged way earlier, so when the tokens traded around $2-5 (3-6% of net asset value) I did try to scoop up some cheap tokens, however a bot managed to scoop them up before me.

The team could easily have prevented the sell-down by entering the Discord server and building trust, but they decided not to do so until later in the day on Friday. Around the same time a thick $10k buy order entered the Uniswap V3 “orderbook” at $5 per token. This from an address which also interacted with Sideshift (which is not used by crypto users commonly). Fertile soil for conspiracy theories.

The one thing the team hasn’t sticked to is the advertised team expenses of 15% of all income generated. The current expenses run at c. 3-5% of assets under management, which is a serious issue.

When the team did show up in the Discord server on Friday we had a good conversation about the above and ways to bring costs down.

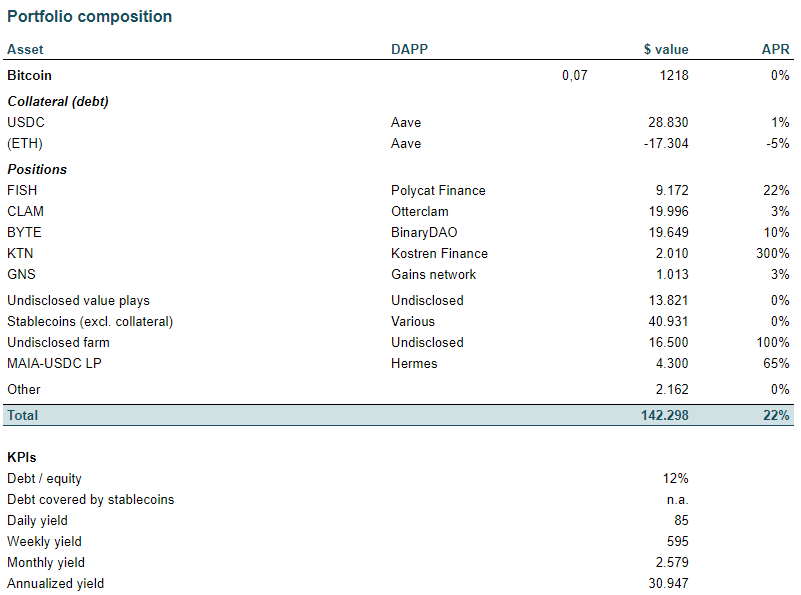

Kostren currently trades at $24, but I valued it at $5 in the portfolio as that is the only place with meaningful liquidity. I see this as the cleanest way to account for the value, despite it being super conservative.

Other updates

Thena Fi provided a nice airdrop worth $170 for me to date, part of the airdrop vests over 3 weeks. I expect it to at least increase to $200+. A nice gift in this bear market. You can check your eligibility here.

My undisclosed farm is down by 15-20%, despite the price of the token being down by 60-70% (price decline offset by farming rewards). I still expect this one to do well over time, but am not very fond of the team who really acts in their own interest at the cost of holders. I am not adding and selling part of the farming rewards to reduce my portfolio allocation over time.

Not a great start of the new year. It’s part of being in the game though.

Scared Money Don't Make No Money :)

On to the numbers!

Results

The portfolio value decreased by c. $18k, mostly as a result of the drop in price and conservative accounting with regard to KTN. The coming weeks might show some upside volatility if things improve at KTN.