God-Ly-Purity

Kostren Finance

I am double dipping into Kostren Finance (KTN). I recently purchased a position, which I exited quickly (below my target price) as it ran up significantly as a result of some threads on Twitter. These moves are often unsustainable. This time was no different. I now re-entered at c. $50. Higher than the first dip, but based on some on-chain analysis I only see a couple of potential sellers at the current price, so I decided to pull the trigger for the 2nd time.

Kostren Finance is basically a closed-end investment fund. The only way for fresh capital to enter is for the price to increase to the current bonding price of $102.

As I explained earlier on this blog, I am looking for assets and cash-flows during this bear market. Kostren Finance ticks both boxes.

It’s a good example of inefficient markets as the dislocation between price and value can be discovered by simple math.

Exec sum: KTN trades at a significant discount to treasury value, which is conservatively managed and mostly tracks markets favorite ($GLP). You get an outsized claim on treasury earnings and thus a boost on GLP earnings - higher than at any competitor. There are several catalysts to close the gap towards treasury value and you are rewarded a nice yield while waiting.

Disclaimer: The market cap currently sits at $240k and liquidity is only $60k (mostly protocol owned). This idea is mostly suited for the smaller investors. As always, nothing on this blog is financial advice, please do your own research. The numbers in this article are based on a KTN price of $55.

KTN trades at a steep discount to the value of the treasury, which is conservatively managed

The team takes a conservative approach with regard to their treasury deployment. As the project is fairly new, they have only deployed about a third of the treasury yet. The rest is still in stables.

The team invests in the below strategies. No degen stuff. I don’t like to invest in DEXes in general, but I don’t mind a small Curve allocation, given the fact that they also work on other income generators (e.g. their own stablecoin).

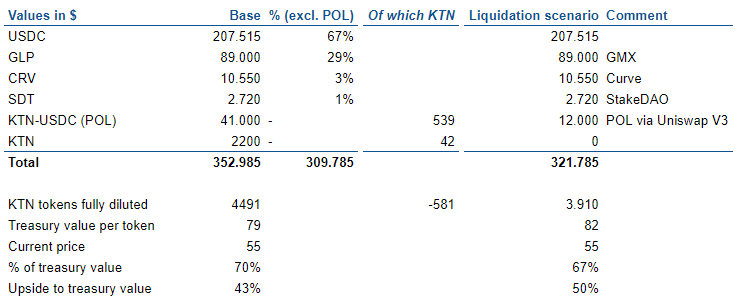

In terms of allocations it currently looks as follows:

KTN trades at 70% of treasury value, resulting in more than 40% upside to treasury value. Competitors on Arbitrum have attracted premiums to treasury value.

The Protocol Owned Liquidity (POL) largely reflects the other investments and can therefore more or less be discarded when looking at the portfolio allocation (the KTN in the POL doesn’t receive dividends).

If we exclude cash and POL we can see that the treasury mostly tracks $GLP, a market favorite which currently stores North of $400m in value.

Market’s have the tendency to discount impure stuff. This is where sum of the part investment strategies come from, which most of the time only work if activists get involved.

A very simple strategy monetized by private equity firms in large volumes, is the divestment of real estate from non-real estate business (e.g. retailers) without impacting the valuation of the non-real estate business (as these were valued by subsequent buyers based on cash-flows, with little attention for the balance sheet).

Some of these buyers (often also PE firms) later found out the hard way that a healthy balance sheet and low cost structure does have value in a downturn (as it increases the odds of survival). And in some cases that they overpaid. Markets are not efficient.

My advice to the Kostren team is to continue the current allocation strategy of God-Ly-Purity to help the valuation and keep activists away.

Yieldmatics

As a KTN owner you have to perform some basic calculations to get to your net yield.

You have to adjust the treasury yield for:

(A) team expenses %

(B) KTN staking %

(C) claim %

(D) esKTN bonus yield

Resulting in the following formula:

Net yield = treasury yield x (100% - A) x (1 / B) x (1 / C) + D

A: team expenses

Of all the yield earned by the treasury, 15% goes toward the team for operational expenses. So 85% accrues to KTN owners.

—>

Net yield = treasury yield x 85% x (1 / B) x (1 / C) + D

B: KTN staking %

In order to be able to claim the yield you have to stake your KTN and get sKTN in return. The last 3 reward cycles only 50% of tokens were staked. This basically doubles your income.

In my view it will always remain below 85% and thus at the very minimum cover for team expenses. This as a result of protocol owned liquidity (currently 581 or 13%), traders who don’t want to lock up their tokens for dividend and dust / lost tokens that build up over time.

—>

Net yield = treasury yield x 85% x (1 / 50%) x (1 / C) + D

C: claim %

Yield has to be claimed manually every cycle in order to receive it. Currently there is a weekly yield cycle, with a 5 day window during which you can claim your yield. If you forget to claim your yield, it will be added to the pool of the next cycle.

Over the last 3 cycles less than 60% of yield has been claimed. That’s a nice bonus. I expect this to initially drop as people become more aware of it, and after that growth over time as a result of dust positions.

—>

Net yield = treasury yield x 85% x (1 / 50%) x (1 / 60%) + D

D: esKTN bonus yield

As only a third of the treasury has been deployed yet, the treasury yield is currently lower than what is to be expected over the long run. The team has created a structure to reward holders with KTN tokens (via dilution which vests over 60 days) to compensate for this.

This yield comes from your own pocket (via dilution), but as explained earlier not all of the KTN tokens can be staked and an even lower amount than the maximum potential is staked. Right now this temporary bonus yield is 30%, while c. 1/3rd of the tokens are staked in this pool, resulting in a net bonus of c. 20%.

—>

Net yield = treasury yield x 85% x (1 / 50%) x (1 / 60%) + 20%

—>

Net yield = treasury yield x 280% + 20%

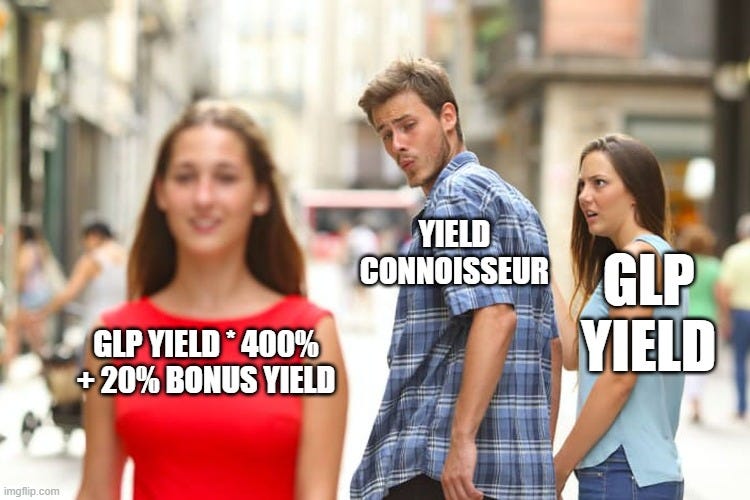

That’s pretty tasty. Now for simplicity sake, let’s assume 100% GLP exposure. As you can buy the tokens for 70% of treasury value this gives another boost of (1/70%) to the GLP earnings. So for GLP lovers, the formula can be adjusted as follows:

Net yield = GLP yield x 400% + 20%

Catalysts

While there are several threads on Twitter with regard to Kostren Finance - they are mostly focussed at what Kostren Finance is and very light on fundamentals. In my view this undervaluation has not been discovered by the market yet.

GLP is the cornerstone of many dAPPS on Arbitrum. Overviews of dAPPS related to GLP, so far do not include Kostren Finance. I expect this to change rather sooner than later. With North of $400m in GLP in the market, only a tiny fraction of market participants need to like the additional yield offered by Kostren Finance in exchange for centralization (controlled by anon dev, no multi-sig) and some impurities.

The DAO voted on using 3% of the treasury value on marketing. This marketing will start once the final functionality of the platform is live (which is the esKTN bonus yield described above, expected to be implemented this week).

Risks

You are investing in an anon team, which has full control over the treasury. Based on their actions to date, communication etc. they come across as a long term oriented team. Needless to say that there always is a rug risk in crypto.

The dev has been offline for a couple of days in a row for multiple times now. This scares investors (myself included). So far he returns every time. With every return my confidence is boosted :)

When looking for safety in DeFi there are many things that provide a false sense of security. If I don’t size my position too crazy I often simply go by my gut feel and assign quite some value to the Lindy effect introduced by Taleb: the idea that the future life expectancy of a non-perishable item is proportional to its current age. Kostren has been alive for a month. Up to another month! ;)

Conclusion

Right now you can buy into KTN at a rock bottom valuation, providing a good margin of safety. I expect KTN to trade up once people start to discover the yield boost. And if it doesn’t in the short term, you get paid a nice yield while waiting.

The risks of owning KTN are obviously a lot higher than having pure GLP exposure. The risk reward makes it very attractive in my opinion.

Treasury addresses:

https://debank.com/profile/0x5a051907b472cbba88e1ecb4286b8426f16ccf6c

https://debank.com/profile/0x236a264214e8cecd84b4a4c758a4d03888e9478a

Token:

https://arbiscan.io/token/0x46ca8ed5465cb859bb3c3364078912c25f4d74de