The last two weeks my research didn’t lead to any interesting investment opportunities I could size into. I have a couple of protocols on my bucket list and will patiently wait for the right price before entering.

I decided to lower my research efforts a bit after a very busy January and February.

I started to explore stablecoin farming opportunities. The most interesting one I am currently farming is the gDAI-gmUSD pool. It requires a bit of research to understand all of the risks. Feel free to dilute me. The net APR is currently c. 50%. More info on the pool can be found here.

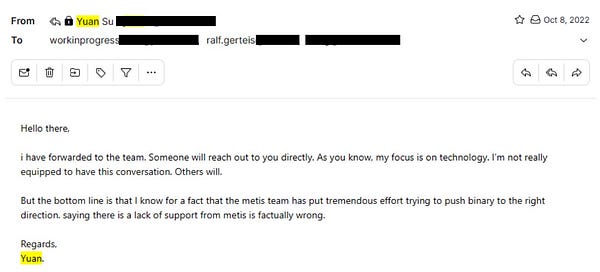

A couple of months ago I released an article on BinaryDAO which explained how they duped investors by stealing $2m in funds and much more.

After that article I did further research which showed clear involvement from the core Metis team. Together with a group of BYTE token holders we engaged with the Metis team and asked them to fix the situation. They continue to deny their involvement despite the clear evidence.

Inspired by further investigation by lilbagscientist into the situation - I am also doing further research. We are currently releasing “The Metis files” on Twitter. Make sure to check out the first posts, it only gets crazier from here.

I did invest (/gamble) a bit into a new degen “Rug or no Rug” play. I will probably release more about this gamble over the next few days.

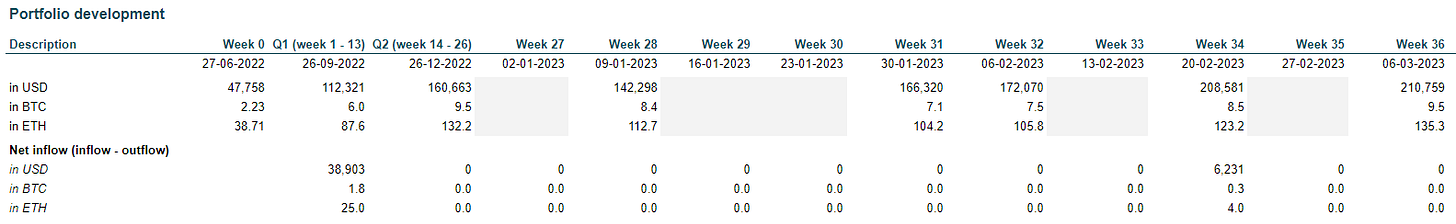

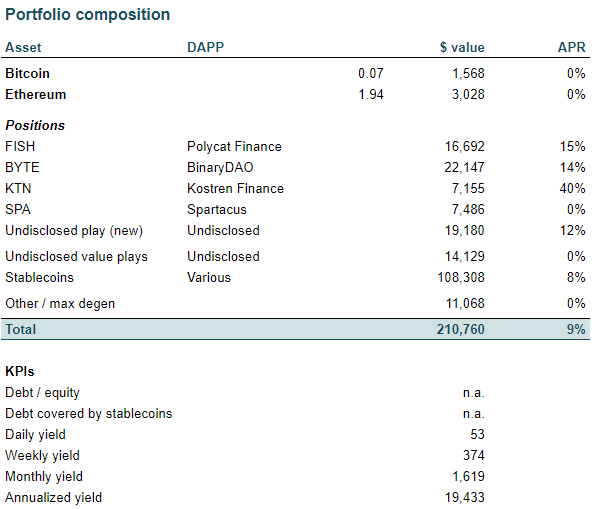

On to the numbers!

Results

The portfolio increased by c. $2k which is mostly the result of an arbitrage trade discussed in my previous update.

The portfolio currently yields c. 9%, there is plenty of opportunity to increase this as only 10-15% of my stables are deployed in farms.