Align your chakra's, buy TETU

Tetu.io (Polygon)

Tuesday I freestyled a thread explaining the significant upside I see for Tetu in the short term. Hereby a more in depth view.

Exec sum / TLDR

Since October 19 2022, a whale poured $6-7m in $veBAL into Tetu’s liquid solution $tetuBAL. This will be with Tetu forever and therefore increased the value of the TETU token significantly. While the token price increased by more than 100% it still trades at a huge discount compared to AURA (the governance token of Aura Finance, a competitor who provides a different liquid solution in the form of $auraBAL). The influx of capital combined with the overall voting power of the whale has set a flywheel in motion which will very likely increase the amount of $veBAL locked on the Tetu platform and thereby further widen the discount compared to AURA. I expect the discount to be closed shortly as a result of several catalysts, most notably an implementation of TETU into Hidden Hand’s bribing platform. There is clear potential for multiples in upside. We are in the early innings of a Balancer war, this won’t go unnoticed.

A short intro into veBAL

BAL (Balancer) owners can lock their BAL tokens for up to one year into veBAL in order to get:

75% of Balancer admin fees

10% of BAL emissions

Voting power to redirect 90% of BAL emissions to gauges (approved LPs on Balancer)

Voting power on other governance proposals

Boosted yield when providing liquidity on Balancer

As you have to lock your BAL tokens for one year to get maximum benefits - you can’t sell these tokens for a year which is far from ideal, especially in a volatile market like crypto.

Both Aura Finance and Tetu come into play here as they developed liquid solutions (with PEG risks) of veBAL. Tetu introduced this c. 6 months ago and Aura c. 5 months ago.

Tetu didn’t benefit from their first mover advantage due to a lack of marketing. Aura therefor quickly took the lead after their launch. Until today Tetu’s solution (tetuBAL) is still barely known to the public.

However, something big changed over the last week. A whale started to lock significant volume into Tetu’s solution, increasing Tetu’s veBAL TVL by more than a hundredfold. This TVL is locked forever, which increases the value of Tetu’s governance token (TETU) significantly. While the price increased by more than 100%, there is much more upside based on a valuation comparison with AURA (the governance token of Aura Finance).

On top of that there are some short term catalysts which might close the valuation gap rather quickly.

Setting a benchmark, the value of the AURA token

When you own AURA and lock this, this gives you veBAL voting power proportional to your AURA stake and all veBAL locked on the platform.

The AURA value is derived from bribing income (i.e. people / 3rd parties paying AURA holders to make use of their veBAL voting power). Voting (and bribing) is done every 14 days. Last round AURA holders received $0.06 per token ($1.56 annualized). AURA trades for $2.50, so that translates into an 62% annualized yield.

Apart from having a liquid veBAL solution (auraBAL), people can also deposit their Balancer LPs into the Aura platform in order to receive boosted yield (enabled by the protocol owned veBAL). The platform takes a 25% fee from this, 20.5% of the 25% is distributed to AURA lockers. At first glance, this looks nice, however it is unsustainable in my opinion. When we look at the boosts achieved by Aura, this is lower than 25% for the majority of TVL. Below a screenshot of the largest pool.

So why do people stake their liquidity on Aura instead of directly on Balancer?

This is the result of additional farming incentives (LP rewards) given to liquidity providers in AURA tokens (highlighted in yellow below). The AURA dilution is not off-set by fees. In the below example the platform takes 25% of the BAL fees, thus 25% * 2.69% = 0.67%, while it subsidizes this with 3.84% via AURA tokens. This is highly dilutive, for this pool alone ($193m in TVL) the annual dilution is worth 3.84% * $193m = $7.4m minus 0.67% * $193m = $1.3m, resulting in more than $6m dilution (16% of the market cap).

50% of all tokens to be minted over time are earmarked as LP rewards and thus dilutive the way they are used at the moment.

So in summary AURA tokens are valuable as a result of significant bribing income, however this value is diluted over time.

The value of the TETU token

Note: While TETU is more than a service provider of liquid veBAL (tetuBAL), I am ignoring all other solutions for the moment as tetuBAL makes up the majority of the value today. TVL in the other solutions has decreased significantly during the bear market.

When you lock your TETU token this gives you veBAL voting power proportional to your locked TETU (dxTETU) stake and part of the veBAL locked on the platform. If people hold tetuBAL, the voting power stays with the holders. If people provide tetuBAL-veBAL liquidity the voting power of the tetuBAL in the liquidity pair is granted to dxTETU holders [1]. Right now > 99% of tetuBAL is held in the LP (as a result of the significant APR on this pool), so basically all veBAL voting power is controlled by locked dxTETU.

As the amount of veBAL on the platform increased by more than a hundredfold, a bribing market will arise in the short run. The team already hinted that Hidden Hand is willing to implement / facilitate the bribing process.

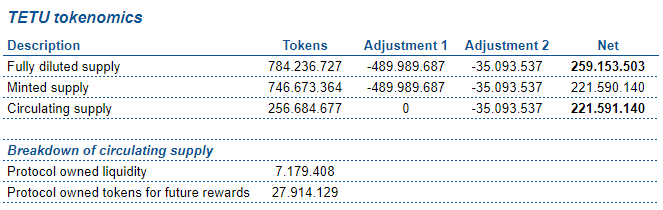

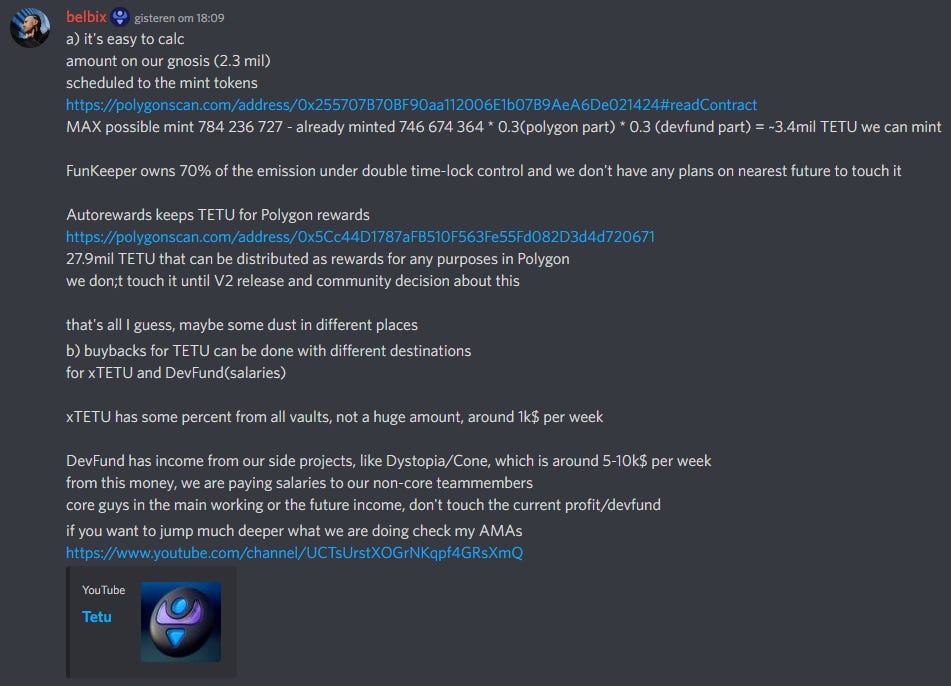

TETU’s circulating supply (see ref [2] for details) consists of 222m tokens. The non core team members are paid from protocol income. The core team currently doesn’t take a salary and is purely working on the token value. This shows a very high level of integrity. No tokens are used for incentivizing protocol use at the moment as there is no clear ROI under the current bear market circumstances. I like it when teams assess the use of token incentivization very carefully. Future incentives will be voted on by TETU holders. So TETU is currently non dilutive.

TETU vs. AURA

The benchmark shows us that based on the current situation TETU is undervalued by 127-215% compared to AURA while:

It has no inflation, where AURA does

TETU has better growth prospects

TETU holds voting power risk

Growth prospects of tetuBAL

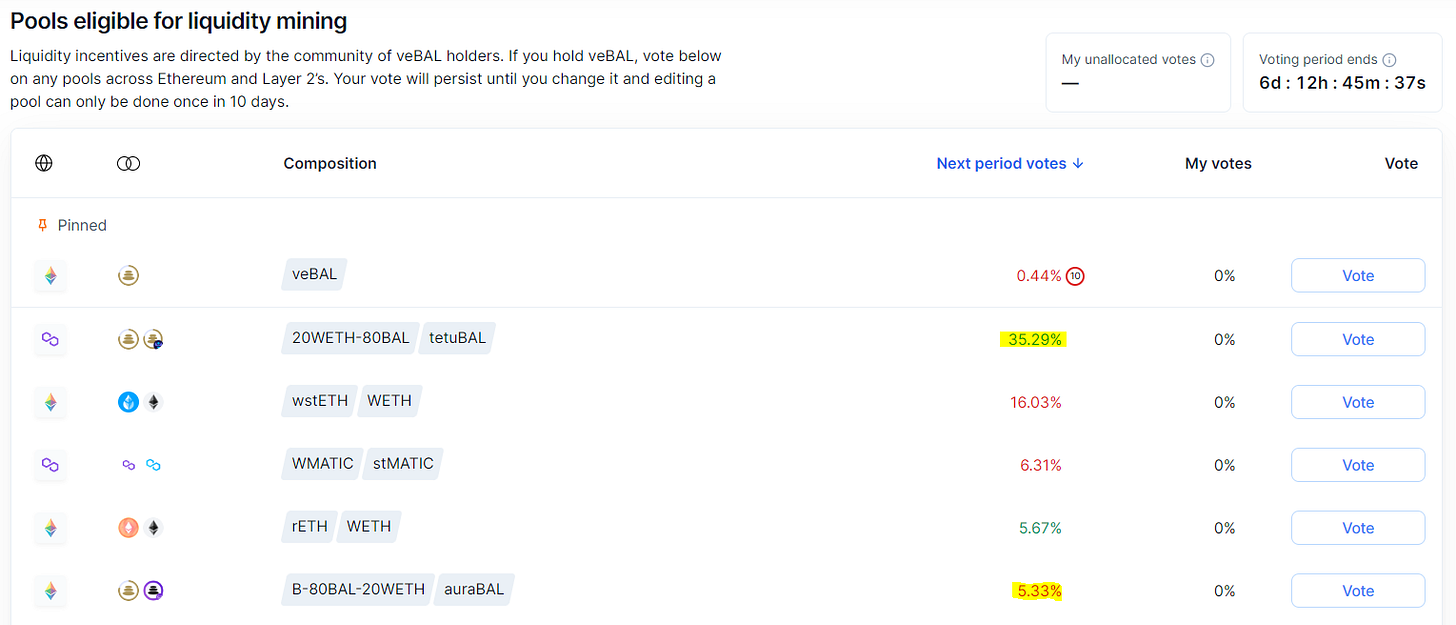

I expect the amount of value to be locked into tetuBAL to increase significantly in the following weeks. The whale who entered Tetu holds a very significant stack of veBAL, which is all used to incentivize the veBAL - tetuBAL pair. The latest vote results show us that the tetuBAL pool received 35% of the votes while the auraBAL pool received 5% of the votes. This while the TVL of the auraBAL pool is 2.6 times higher than that of tetuBAL. So we are looking at a (35/5) * 2.6 = 18 times difference in emissions per $ in TVL.

The projected emissions for the auraBAL-veBAL pool are 52%, of which 37% comes from dilutive AURA rewards and 15% comes from real yield. Based on the factor 18 difference in emissions per $ TVL as explained above the tetuBAL-veBAL pool should start at 18 * 15% = 270% as of next week. More than 5 times what can be earned on AURA. I am pretty sure that this will result in an influx of people who start to lock into tetuBAL in order to benefit from this yield.

I do expect this big gap in yield to remain for quite some time. First of all the gap is very significant (factor 5). I also expect downwards pressure on the AURA price as people find out about TETU. As 37% out of the 52% is incentivized via AURA this % will reduce as the price of AURA drops. This should give TETU a long runway to attract more veBAL TVL, increasing the value of TETU.

The Balancer War has begun. The whale has made its move via TETU, now we have to wait and see how AURA reacts to it. Interesting times ahead of us.

Tetu’s voting power risks

Where locked AURA tokens (vlAURA) control 100% of the voting power of veBAL locked on the platform, locked TETU tokens (dxTETU) only control the part of tetuBAL locked in the Balancer LP. Tetubal holders who simply hold it in their wallets keep their voting power, however don’t accrue any earnings [1].

So the question is whether a scenario might arise where it makes sense for the whale to remove tetuBAL from the LP.

In my view this is very unlikely. Right now it is far more economical for the whale to acquire TETU to secure voting power than to loose yield by removing tetuBAL from the LP and thereby reducing his pool share. This is an actual catalyst for the TETU price to go up :)

I also ran a scenario analysis with varying:

TVL growth (good for TETU, pool dilution for the whale but at the same time good for the Balancer value)

% of votes on the tetuBAL-veBAL pool (as a result of bribes redirecting votes to other pools)

The result of this scenario analysis is that it is more beneficial for the whale to keep the tetuBAL in the LP under most circumstances [see ref 3 for details].

There are several short term catalysts to increase TETU’s value and narrow the valuation gap compared to AURA

Most of these catalysts have already been covered, here is a brief overview.

The likely short term implementation into Hidden Hand will create an efficient bribing market and market awareness

tetuBAL TVL growth, as a result of a very high APR on the tetuBAL-veBAL LP, will increase the veBAL voting power controlled by TETU

The whale is slowly accumulating TETU and will likely continue to do so

The Balancer war will likely become a hot topic in the crypto community raising further TETU awareness, this war could also drive the price of BAL up due to awareness and more BAL being locked

AURA owners can receive more bribing income when converting their AURA to TETU. As a bonus TETU is not dilutive while AURA is. A no brainer move IMO, especially for smaller players (TETU liquidity is thin).

There are some other interesting Balancer developments which could drive value, such as the latest AAVE proposal.

Key risks

As often with crypto, things are very fluid. There are many variables to take into account and as these change the thesis has to be re-assessed. I see the below key risks:

The whole thesis is dependent on the valuation of Balancer. As the price of BAL moves to the upside or downside, so does the value of TETU (and AURA).

Aura Finance will try to protect their market share. They might try to fight this war via Balancer governance proposals (e.g. putting a cap on the emissions of the tetuBAL pool), which would hamper growth (but not remove the existing relative undervaluation).

The TETU market is illiquid.

Calculation errors / logical flaws in my thesis. Defi is complex.

Conclusion

There is a significant valuation gap between AURA and TETU, which is expected to grow as a result of tetuBAL TVL growth. There are very tangible catalysts on the short term horizon to close this valuation gap. I don’t see a lot of downside risk in TETU at current prices if the market remains stable. Therefor I have allocated a good part of my portfolio to this idea, but not too crazy.

I am mostly a fundamental investor and I don’t hold a very strong long term view on the value of Balancer. Valuation of DEXes and the like is complex. That’s the reason why I am not “all-in”.

The undervaluation of TETU is only one of the opportunities that arises from the recent developments. The Balancer war has started resulting in other opportunities with a nice risk/reward (not as good as TETU), where you can scale in with size. Feel free to reach out to me on Twitter to discuss those.

Research details / notes / references

[1] tetuBAL voting power

https://docs.tetu.io/tetu-io/yield-farm/strategies/tetubal#tetubal-multi-sig

[2] Tetu tokenomics

The tokenomics in the documents are not 100% up to date. Below an overview including some adjustments I made based on comments from the team.

The majority of tokens have been earmarked not to be used in the near future as the team sees currently no opportunities where that would result in ROI (which makes sense).

489m + 7m protocol owned liquidity: https://debank.com/profile/0x7ad5935ea295c4e743e4f2f5b4cda951f41223c2

28m: https://debank.com/profile/0x5cc44d1787afb510f563fe55fd082d3d4d720671

If we adjust for this we get to a total circulating supply of 222m tokens.

[3] Scenario analysis